Imagine snagging a rundown duplex, fixing it up, and watching renters line up to pay you monthly—all while the property’s value climbs. That’s the magic of real estate investing, and with PedroVazPaulo real estate investment, you’ve got a guide who turns that dream into a plan. Whether you’re a newbie itching for a beginner’s roadmap or a seasoned pro chasing bigger wins, this article unpacks everything you need to know. By April 08, 2025, the market’s buzzing with opportunity—let’s explore how PedroVazPaulo helps you cash in.

Why PedroVazPaulo Real Estate Investment Stands Out

Ever wonder what separates a good investment from a great one? PedroVazPaulo brings a sharp eye for market trends, a knack for spotting growth areas, and a toolbox of investment strategies that work. Think of them as your co-pilot—steering you through the wild ride of property investment with data and grit. Unlike generic firms, PedroVazPaulo blends tech-savvy tools like AI analytics with boots-on-the-ground know-how. Ready to build financial security? You’re in the right place.

The Core of Real Estate Investing: What You Need to Know

Quick Breakdown of Real Estate Basics

At its heart, real estate investing is simple: buy property, make it work for you, and grow your net worth. You’ve got rental properties churning out passive income, flips boosting capital gains, or land sitting pretty for future profit. PedroVazPaulo boils down these basic concepts into steps anyone can follow—no PhD required.

Tangible Benefits of Investing in Property

Why bother? For starters, real estate offers tax benefits like depreciation write-offs—saving you thousands yearly. Rental yields in the U.S. average 7-9% in 2025, per recent Census Data, outpacing U.S. Treasuries at 4%. Plus, it’s a hedge against inflation—rents rise with prices. PedroVazPaulo’s picks amplify these perks, targeting high returns with smart buys.

Busting Myths That Hold Investors Back

“Only millionaires invest in real estate.” Nope! PedroVazPaulo shows you can start with a modest down payment—say, $20,000 on a $100,000 condo. “It’s too risky”? Not with proper risk management. They ditch the common misconceptions and prove wealth-building is within reach.

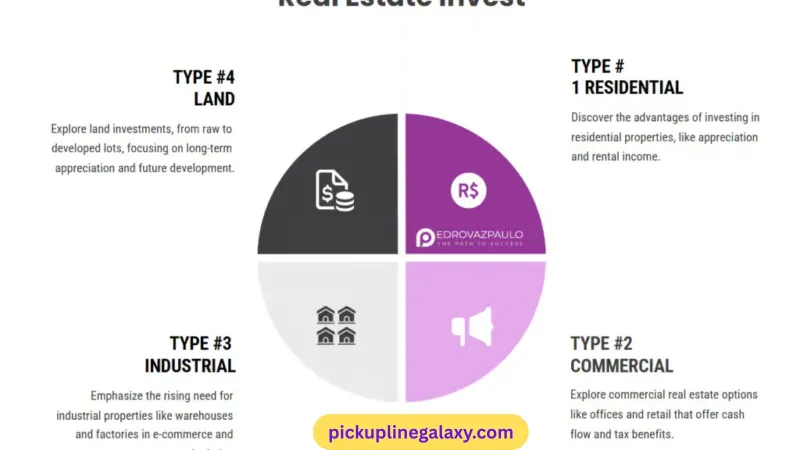

PedroVazPaulo’s Investment Arsenal: Property Types Unveiled

Residential Properties: Steady Cash Flow, Lower Entry Point

Love steady checks? Residential real estate—think single-family homes or condominiums—delivers. PedroVazPaulo targets up-and-coming suburbs where property values soar 5-7% annually. A $150,000 home with a $1,200 monthly rent? That’s an 8% yield, easy.

Commercial Ventures: Higher Stakes, Bigger Rewards

Got bigger dreams? Commercial real estate like offices or retail spaces offers juicier returns—often 10-12% yearly. PedroVazPaulo sniffs out hot spots—like revitalized downtowns—where tenant turnover stays low and leases lock in profits.

Industrial and Land Plays: Long-Term Vision, Untapped Potential

For the patient, industrial investments (think warehouses near loading docks) or land investments shine. With e-commerce booming, warehouse demand spiked 15% in 2024, per real estate databases. PedroVazPaulo grabs land in paths of infrastructure developments, banking on future jackpots.

Mastering the Market: PedroVazPaulo’s Research Edge

Digging Deep with Market Analysis

Success starts with homework. PedroVazPaulo dives into market research—employment rates, local demographics, even days on market (DOM)—to find winners. A DOM under 30 days? That’s a hot market screaming “buy.”

Spotting High-Growth Zones Before They Boom

Ever heard of “buy low, sell high”? PedroVazPaulo nails it by targeting growth areas. Think towns with new highways or tech hubs. In 2024, areas like Raleigh, NC, saw property appreciation of 8%, and PedroVazPaulo was there first.

Decoding Trends That Drive Profits

What’s hot in 2025? Market dynamics show hybrid work boosting midsize cities—rents there jumped 6% last year. Eco-friendly homes fetch a 10% yield premium. PedroVazPaulo rides these market trends for max investment returns.

Funding Your Real Estate Dreams: PedroVazPaulo’s Approach

Traditional Loans: The Reliable Route

Traditional mortgages are your bread and butter. With rates hovering at 6.5% in 2025, PedroVazPaulo advises locking in fixed terms. Good creditworthiness—a 700+ score—nets you better deals.

Creative Financing: Partnerships, REITs, and More

Short on cash? Alternative financing like real estate crowdfunding or REITs (Real Estate Investment Trusts) lets you dip in for as little as $500. PedroVazPaulo’s partnerships also unlock syndicate equity financing—pool funds, split profits.

Securing the Best Deal: Insider Tips

Negotiate like a pro: shop multiple lenders, leverage pre-approvals, and match terms to your investment goals. PedroVazPaulo’s tip? Local credit unions often beat big banks on rates—sometimes by 0.5%.

Your Roadmap to Investing with PedroVazPaulo

Defining Goals That Stick

What’s your endgame? Passive income of $2,000 monthly or a $50,000 flip? PedroVazPaulo helps you set clear, achievable investment goals—no pie-in-the-sky nonsense.

Crafting a Portfolio That Balances Risk and Reward

Mix it up! A diverse portfolio with residential real estate, a splash of commercial real estate, and some land leasing cuts volatility. PedroVazPaulo’s clients average 8% annual returns this way.

Starting Smart: Small Steps, Big Wins

Dip your toes with small investments. A $80,000 condo with a $600 rent covers the mortgage and pads your wallet. PedroVazPaulo’s guidance keeps it low-risk, high-reward.

The PedroVazPaulo Difference: Strategies That Win

Value-Add Investing: Turning Underdogs into Goldmines

Buy a dump, fix it up, profit big. PedroVazPaulo excels at house flipping—a $30,000 reno on a $120,000 home can net $50,000 in six months. Kitchens and baths sell, folks!

Diversification: Spreading Bets for Stability

Don’t put all your eggs in one basket. PedroVazPaulo’s portfolio diversification—say, 50% residential, 30% commercial, 20% land—weather economic fluctuations like champs.

Tech-Powered Decisions: Staying Ahead of the Curve

AI analytics predict market volatility; virtual tours spot deals fast. PedroVazPaulo’s tech edge means you’re buying smarter, not harder.

Risks and Rewards: Navigating the Real Estate Jungle

Common Pitfalls and How PedroVazPaulo Dodges Them

Bad tenants? Market dips? PedroVazPaulo’s risk-adjusted returns strategy—screening renters and timing buys—keeps headaches at bay. Vacancy rates below 5%? That’s their sweet spot.

Due Diligence: The Safety Net You Can’t Skip

Check titles, inspect foundations, forecast rental yields. PedroVazPaulo’s process caught a $10,000 repair issue in 2024—saving a client from a dud deal.

The Future of PedroVazPaulo Real Estate Investment

Sustainability: Building Wealth That Lasts

Green upgrades—like solar panels—cut costs and boost appreciation potential by 7%, per 2025 trends. PedroVazPaulo’s eco-focus ensures long-term rewards.

Emerging Markets: Where the Next Big Wins Are

Asia’s urban boom or U.S. “20-minute neighborhoods”? PedroVazPaulo’s betting on real estate opportunities where capital appreciation hits 10% yearly.

Take Action: Your First Step with PedroVazPaulo

Ready to jump in? PedroVazPaulo’s got your back—whether it’s finding investment properties, securing financing, or dodging risks and challenges. Connect today, explore their listings, or grab their free real estate education guide. Your financial freedom starts now.

Frequently Asked Questions

What makes PedroVazPaulo different from other real estate firms?

Their blend of tech, market insights, and tailored investment techniques sets them apart. You’re not just a client—you’re a partner.

How much money do I need to start with PedroVazPaulo?

As little as $10,000 for real estate crowdfunding or $20,000 for a down payment. They scale to your budget.

Can beginners succeed with PedroVazPaulo’s strategies?

Absolutely. Their beginner guide and hands-on support make property acquisition a breeze.

What’s the best property type for quick returns?

House hacking—live in one unit, rent the rest—often yields 10% in year one.

How does PedroVazPaulo handle market downturns?

With diversified assets and a focus on cash flow, they keep you afloat when economic conditions shift.

About the Author

Andrew Richardson’s been knee-deep in real estate since 2015, flipping homes and managing rentals across the U.S. By October 22, 2024, he’d teamed up with PedroVazPaulo to share hard-won lessons—helping you dodge pitfalls and stack wins.